By Dan C. Deacon and Eric J. Conn

As of January 2, 2018, civil penalties for workplace safety and health violations issued by federal OSHA increased again by 2% across the board. Although a 2% increase does not shock the system, this increase is part of a program that has resulted in OSHA’s civil penalty authority nearly doubling since 2016.

History of Civil Penalty Adjustments

As I sit here this afternoon wondering if the government will shut down over disputes about immigration and healthcare, I am reminded of a time just a couple of years ago, in late 2015, when we were again on the verge of a government shutdown over abortion rights and deficit spending. That shutdown was averted thanks to a backroom deal between outgoing Speaker of the House John Boehner and President Obama, which ultimately took the form of the Bipartisan Budget Act of 2015. That “kick the can down the road” measure included a controversial statute that was essentially unknown (including by the folks within OSHA) and saw exactly zero seconds of debate on the floor. It was called the “Federal Civil Penalties Inflation Adjustment Improvements Act,” and it mandated that executive agencies increase their maximum civil penalty authority by the percent increase to the Consumer Price Index since the last time the agencies had raised their penalties.

On June 30, 2016, the Department of Labor issued its Interim Final Rule to implement the Civil Penalty Inflation directive. OSHA’s civil penalty authority had been stagnant for as long as any other agency, not having been increased for 25 years (since 1990), so this “catch-up” penalty increase for OSHA was the most significant. Indeed, following the formula included in the statute, OSHA was required to increase its penalties on August 1, 2016 by the same percentage increase as the growth from the 1990 Consumer Price Index – Urban (CPI-U) to the October 2015 CPI-U, which was nearly 80%:

In addition to the one-time 80% “catch up” increase that went into effect on August 1, 2016, OSHA’s Interim Final Rule, the Federal Civil Penalties Inflation Adjustment Improvements Act also required the agencies to establish a process for automatic annual updates (by January 15th each year) of civil penalties to keep pace with inflation going forward. OSHA made its first automatic annual update on January 13, 2017, just prior to President Trump’s inauguration. That first automatic increase was a little more than 1% – from $12,471 to $12,675 for Serious and Other-than-Serious citations, and from $124,709 to $126,749 for Repeat and Willful citations.

2018 Civil Penalty Adjustments

Despite a transition to a Trump Administration while the Republicans still control Congress, the automatic annual penalty increase directive has not be revisited. Accordingly, on January 2, 2018, OSHA issued its latest Final Rule to execute another annual penalty increase, this time by approx. 2%:

As provided by the Inflation Adjustment Act, the increased penalty levels apply to any penalties assessed after the effective date of the Final Rule. Accordingly, for citations issued on or after January 2, 2018, even if the citations relate to conduct or conditions that only existed prior, the higher penalty authority will apply.

What Practical Effects Can Employers Expect?

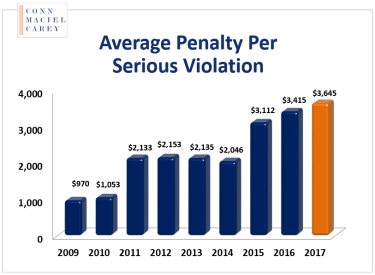

The impact of the catch-up increase back in 2016 was significant for violations of all stripes. The result for Serious violations was to nearly double the average penalty per Serious violation. However, the current program of annual increases has created pretty negligible impacts on Serious and Other-than-Serious violations. Max civil penalty authority for Other-than-Serious and Serious violations only increased this year by $319, from $12,615 per violation to $12,934 per violation.

Conversely, although the percentage increases are minor, the result is still meaningful for Repeat and Willful violations, where the gross dollar increases are measured in the thousands of dollars, from $126,749 to $129,336. All told, since 2016, the max penalty for Willful and Repeat violations has jumped by $60,000, from $70,000 per violation to $129,336 now.

It is important to note that the penalty increases being reported are just increases in the “maximum” per violation penalties OSHA is permitted to issue. More often than not, however, OSHA does not exercise its maximum penalty authority. There are numerous penalty reduction factors that OSHA can apply before citations and proposed penalties are issued. For example, small employers usually get a “size discount,” employers with prior “in-compliance” OSHA inspections get a “good history discount,” and employers who engage with OSHA in good faith during the inspection can get a “good faith” discount. So, despite an increase over the last three years of a max penalty for Serious violations from $7,000 to $12,615, the average penalty per Serious violation last year was only just $3,600.

OSHA is much more likely to use its maximum penalty authority when it is citing large employers with a history of violations, or just about any circumstance when there has been a serious injury, or worse, a fatality. In those cases, when OSHA was flexing its muscles as hard as it could, it was still hard for OSHA to issue a ton of significant enforcement actions. That has changed with the new penalty authority. In FY 2017, the first full year after the 80% catch-up penalty increase, we saw a 40% increase in OSHA citation packages with cumulative penalty greater than $100,000. Indeed, it was the most cases of that size in OSHA’s history:

State OSH Programs Must Impose Penalties “At Least As High” as Federal OSHA

Although Congress did not mandate in the Federal Civil Penalties Inflation Adjustment Improvements Act that the nation’s many fed OSHA-approved state occupational safety and health regulatory programs (e.g., Cal/OSHA, NC OSHA, etc.) must also update their penalty levels, federal OSHA took that upon itself. OSHA notified all of the State OSH Programs that it expects them to adopt penalty levels at least as high as fed OSHA’s new maximum penalty levels to maintain their approved status. Just as importantly as the mandate that the State OSH Programs increase their maximum civil penalties, federal OSHA mandated that the States adopt fed OSHA’s penalty “policies,” such as maximum allowable penalty reductions for small businesses, penalty minimums, discounts for good OSHA history and good faith, etc.

Several states questioned the legitimacy of that directive, and asserted that they were not required to match the new penalty levels. However, OSHA gave guidance to the states just days before President Trump took office in its 2017 Final Rule adjusting OSHA’s civil penalties, explaining:

“OSHA-approved State Plans must have maximum and minimum penalty levels that are at least as effective as federal OSHA’s,” and OSHA expressed that this includes penalties that match the penalty amounts set by federal OSHA. “Therefore, all State Plans must increase their maximum and minimum penalty levels to be at least as high as OSHA’s initial catch-up maximum and minimum penalty levels in 29 CFR 1903.15(d), and must thereafter increase these maximums and minimums based on inflation.”

Many states resistant to these changes were hoping that the Trump administration would reverse this requirement and permit State OSH Programs to set penalty levels independently from fed OSHA. For now, however, this directive has not been revisited.

Because each state has its own legislative or rulemaking process needed to make changes to their regulatory landscape, the various state plans have flexibility when they will increase penalties, and some are just now updating penalties from the first jump a couple of years ago.